고정 헤더 영역

상세 컨텐츠

본문

The Free Fillable Forms program offers online tax forms that people can use to input their information and then either electronically file with the .... File with approved tax preparation software. If you don't qualify for free online filing options, you can still file your return electronically with the help of commercial ...

We break down the top online tax filing companies that actually offer free tax filing software for federal and state returns.

file taxes online

file taxes online, file taxes online canada, file taxes online canada free, file taxes online free 2020, file taxes online h&r block, file taxes online turbotax, file taxes online self employed, file taxes online jackson hewitt, file taxes online and get a refund advance, file taxes online free reddit

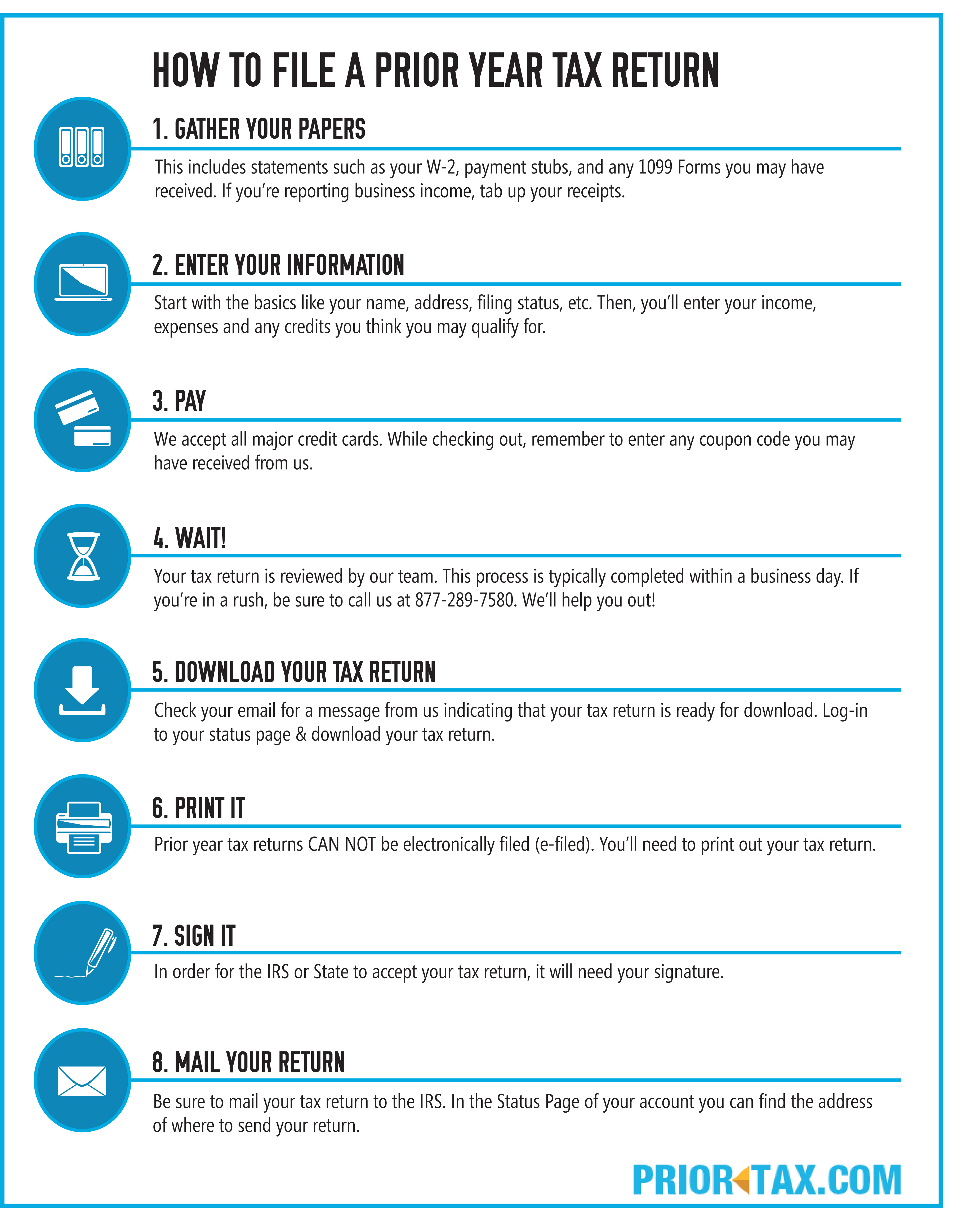

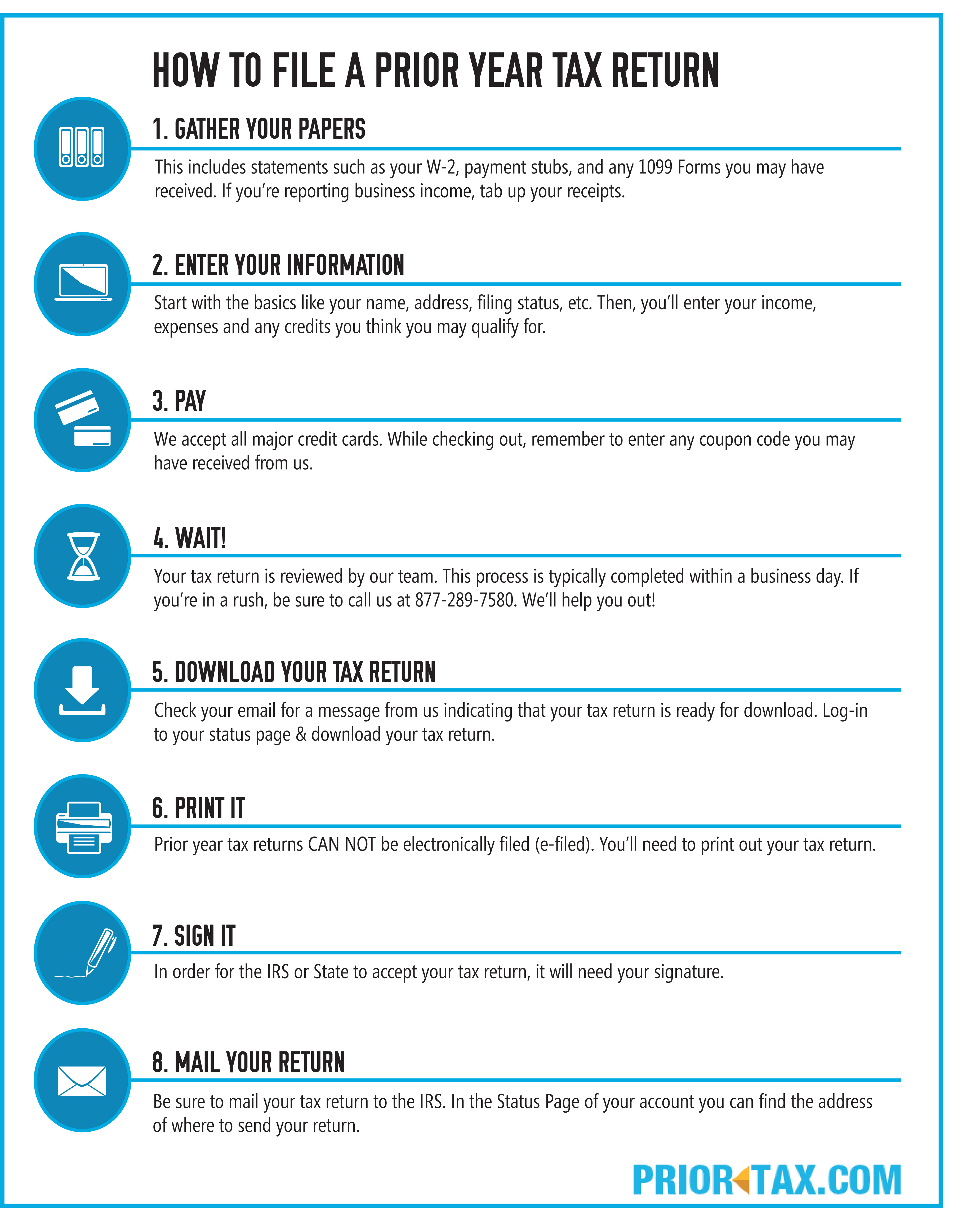

If you're wondering how to file taxes online or on paper, here's some help on how to do your taxes (for free, even) and how to make tax filing easier.. If you have to file a prior year return, forms are listed below by tax year. ... The timely tax filing and efile deadlines for all previous tax years—2019, 2018, and .... Filing returns online. Some, but not all, tax returns can be filed through the Department of Revenue's eFile/ePay portal. The following taxes can ...

file taxes online canada free

file taxes online free reddit

The online Bachelor of Arts in Accounting from UAGC teaches ... Nearly half of all Americans file tax returns each year, and many of them turn to .... MyTax.DC.gov ... MyTax.DC.gov is now live with 24/7 access. Visit the District's new online tax portal to view and pay your taxes. For many tax types, you can even .... The Taxation and Revenue Department (TRD) encourages you to file electronically whenever you can. · Online Services.. Filing Taxes Online for Free. If you have a simple tax return with just W-2s and/or unemployment income, you may be eligible to file your taxes for .... File New Jersey payroll tax returns, submit wage reports, and pay withholding taxes: If you use this option, you can file forms NJ927, NJ-W-3(with W-2 and 1099) .... Online Taxes tax preparation service provides simple, fast and secure tax preparation software and online tax help for online filing of your income tax return.. CT filing, payment deadlines for individual income tax returns extended to May ... File Form W-2, Forms 1099-R, 1099-MISC and W-2G · Business Online- log in .... The Free File Alliance is a nonprofit coalition of industry-leading tax software companies partnered with the IRS to help millions of Americans prepare and e-file .... File Tax Exemption Request Online. April 8, 2021. Current per capita tax exemptions can now be submitted online using Keystone's e-Pay. This service will .... Welcome to Online Filing and Payments. You have arrived at Louisiana File Online, your gateway to filing and paying your state taxes electronically. Louisiana .... File using a free online eFile provider (NCfreefile) – eligibility requirements vary ... An electronic method of filing and paying state and/or federal taxes using .... 1040NOW Online Tax Preparation and Filing. Free federal and MA tax preparation & e-file for all who live in MA with an Adjusted Gross Income (AGI) of $32,000 .... The NJ Online Filing Service is for resident income tax return filers, including first time filers. The service is free and most all taxpayers may use .... Pay taxes online with this list of the best online tax filing softwares compiled by financial experts, with options from TurboTax, H&R Block, and .... Online tax filing software you can depend on · You could do your taxes online in as little as 30 minutes* · One simple price, for all types of filers · File .... With 1040NOW, you can prepare and file your federal and Rhode Island personal income tax returns online at no charge if: ... You live in Rhode Island and your .... FileYourTaxes.com is an online tax service. File your Federal & State taxes fast, easily & securely. We provide secure e file service to the IRS. Start today!. Free Federal Returns Only: FreeTaxUSA. FreeTaxUSA's free e-file offer. If you live in a state that doesn't require you to file a state tax return, .... The best way to communicate with the Tax Department about your return is to create an Online Services account and request electronic .... And we really do mean FAST. File taxes online in as little as 15 minutes. Built for both speed and accuracy — 30,000+ Liberty Tax® preparers use our tax software .... Welcome to the Comptroller of Maryland's Internet tax filing system. This system allows online electronic filing of resident personal income tax returns along with .... File your taxes online or by paper, or find other options to have someone else complete them for you: Certified tax software (electronic filing); Authorize a .... Nebraska Driver's License or State ID for e-filing This filing season, the Nebraska Department of Revenue, along with many other state revenue agencies, .... 100% Free Tax Filing. Efile your tax return directly to the IRS. Prepare federal and state income taxes online. 2020 tax preparation software.. The two best-known online tax filing services are TurboTax and H&R Block, and they're the ones that we recommend you use. Both allow you to .... How would you like to file your taxes? By myself. With assistance. I'm not sure. Could you choose something, please. Great! Let us connect you to our free online .... Online Taxes at OLT.com would like to offer free federal and free state online tax preparation and e-filing if your Federal Adjusted Gross Income is between .... ... File makes doing your Federal taxes less taxing, either through brand-name software or fillable forms that do the hard work for you. This online tax preparation .... Information and online services regarding your taxes. The Department collects or processes individual income tax, fiduciary tax, estate tax returns, and property .... Everybody wants to get filing taxes over with quickly, with as little fuss as possible. That's why online tax software comes in very handy at tax .... Free online filing of federal and Vermont returns with Intuit, if: Any taxpayer with Adjusted Gross Income (AGI) of $39,000 or less, or. Any active-duty military with .... Read our plain-language guide to filing your 2020 small business tax ... When you file your own taxes online with the IRS (sometimes called .... KS WebFile. KS WebFile is a FREE online application for filing Kansas Individual Income tax returns. Refunds can be deposited directly into your bank account.. 2021 Filing Season Information The deadline for filing 2020 individual tax returns is ... IR-42, and BR-42 can use our Payment Portal application to file online.. Please keep in mind the following: Qualifying taxpayers can prepare and file both federal and Georgia individual income tax returns electronically using approved .... File Form IL-1040, Individual Income Tax Return, on MyTax Illinois ... Use MyTax Illinois to electronically file your original Individual Income Tax Return. It's easy, .... Online Services. South Carolina offers several options for filing Individual Income Tax returns. Filing electronically is the fastest and easiest way to complete your .... Learn how to file a federal income tax return or how you can get an extension. ... information, the IRS recommends finding answers to your questions online.. Yes, you can file your 2019 federal taxes online for free — but it pays to be smart about it. The IRS struck a deal with tax preparation software .... How filing online impacts your tax refund. The best part about filing your taxes online is that you're not relying on physical mail, which means the .... Maine Revenue Service's solution to fast and secure tax filing. ... software either over-the-counter or online, prepare your own return and press send to e-file.. E-Filing/Online Payments. Who Can E-File? Individuals: We offer E-File for the annual tax returns for individuals and .... Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business: (1) Administer tax law for 36 taxes and fees, .... TurboTax® is the #1 best-selling tax preparation software to file taxes online. Easily file federal and state income tax returns with 100% accuracy to get your .... File your 2017 Personal Income Tax Return online as well as file a late return for tax years 2014, 2015 or 2016.. For businesses and other taxpayer audiences, see the links to the left. Use IRS Free File or Fillable Forms. Use a Free Tax Return Preparation Site. Use Commercial Software. Find an Authorized e-file Provider.. File your Taxes online with ezTaxReturn. Authorized IRS e-File Provider guaranteed to get you the biggest possible refund. Free to try - start today!. The most helpful tool to file your taxes online is TurboTax. Use the IRS Free File version if you qualify, or start with the Free Edition if you don't.. NevadaTax is our online system for registering, filing, or paying many of the taxes administered by the Department. With it, you can manage your own tax .... https://turbotax.intuit.com How to file your taxes online in 3 simple steps: At TurboTax, we get you. We've made .... FreeTaxUSA is a robust online personal tax preparation service that lets you e-file federal tax returns for free, though you have to pay for state filing and extra .... How do I file taxes online? How do I sign up for TurboTax, H&R Block or Tax Slayer? Can I hire an expert? Updated 4:00 AM; .... Go to Webfile Online Tax Filing ... Depending on the tax, Texas taxpayers may be required to electronically report (file) and/or pay based on the amount reported .... Overseas Taxpayers Can Use IRS Free File to Prepare and E-File Tax Returns ... The Internal Revenue Service (IRS) advises that U.S. citizens and resident aliens .... Filing taxes online can speed your refund and reduce errors, but sometimes you may be required, or may want, to file a paper return. Learn which is best.. This section discusses methods for filing and paying your taxes, including how to file online—the fastest and safest way to file. You can also pay online and .... Revenue Online: You may use the Colorado Department of Revenue's free e-file and account service Revenue Online to file your state income tax. You do not .... File & pay taxes. Learn how to file electronically · File my taxes online · Learn about tax incentives, deductions, credits, and programs .... You can e-file your taxes free with the IRS at the filing portal link, at IRS Free File. You'll need to have an adjusted gross income (AGI) of $66,000 .... Alabama Direct E-filing Option. You can file your Alabama Resident and Non-Resident returns online through My Alabama Taxes (MAT) at no charge. This free .... Free Online Tax Filing for California Returns. United Way has joined forces with H&R Block as well as the Internal Revenue Service (IRS) to offer Orange County .... Because of the issues people were dealing with last spring, the filing deadline for federal tax payments was moved from the usual mid-April date .... Wisconsin Department of Revenue: Wisconsin e-file, Electronic Filing ... 3/17/2021, Unemployment Compensation on 2020 Wisconsin Income Tax Returns.. Yes! Credit Karma Tax is always 100% free. It's $0 to file both state and federal tax returns. Even if you're taking deductions or credits, .... Even though I fix other people's computers for a living, bank online, and do a lot of ... Corporations can electronically file Form 1120, US Corporation Income Tax .... Breadcrumbs: Home · file · ways to file · online; calfile. CalFile. Back to File online 1; CalFile .... How to find free tax filing online · What if my AGI was above $72,000? · How to use the Free File Program · Filing state and local income taxes.. Manage your accounts online. Through TAP you can: E-file returns. Auditorium districts (Form 1250, 4150, or .... Back taxes are any past-due tax returns you have, whether you owe money or expect a refund. You can e-file some back taxes through certain online filing .... Prepare and file your federal and state income taxes online. Maximum refunds, 100% accuracy guaranteed. One flat-rate price for everyone – just $25.. Breaking: Sprintax is Now LIVE For Nonresident Federal E-Filing! It has never been easier to file your nonresident US federal tax return. We are .... Many programs limit free filing to people who use the online self-service version of their tax preparation tools. Free Filing for Both Federal and .... File Online. Individuals who are ready to file a municipal income tax return in one online session can file using FastFile. No login, User ID or Password is .... Online Taxes at OLT.com would like to offer free federal and free state online tax preparation and e-filing if your Federal Adjusted Gross Income is between .... E-file's online tax preparation tools are designed to take the guesswork out of e-filing your taxes. Our program works to guide you through the complicated filing .... What is Free File, and who is the Free File Alliance? · 1040NOW Corp. · ezTaxReturn.com · FileYourTaxes · Free Tax Returns · Intuit · OnLine Taxes .... Whether it is your first time filing taxes on your own, or you are just looking for some ... IRS online forms: If your adjusted gross income is higher than that limit, the .... Free Online – tax filing that helps you save. H&R Block's Free Online tax filing service gives you more for free than TurboTax Free Edition. Parents, employees, and .... Electronic Filing (E-File) — Can I file my Oklahoma personal income tax return ... you file electronically, the computer software or online .... If you have a simple tax return, you can file your taxes online for free with TurboTax Free Edition. Just import your W-2, answer basic questions about your life, .... Filing by Hand vs. Using Online Software — You can file your taxes through an independent tax software program, app or online forum. You .... Online Taxes at OLT.com would like to offer free federal and free state online tax preparation and e-filing for: Any taxpayer with a federal adjusted gross income is .... Your guide to filing your taxes free of charge. · Visit the Free File Alliance. · Use free fillable online forms. · Use the software providers' own free .... Most Tax-Aide services have concluded for the 2020 tax season to align with the July 15 extended filing deadline. If you are a taxpayer who still has an .... Welcome to the Minnesota Department of Revenue website. We provide information to help you report and and pay Minnesota taxes, along with tax research, .... If you have questions about the software product when filing your return, you must contact ... FREE Federal and MI tax preparation and e-file if:.. E-file for free: A safe, convenient online filing option available from reputable vendors that allows qualifying individuals to file their state and federal returns for .... File Your Taxes with NYC Free Tax Prep. NYC Free Tax Prep Service Options. Expand AllCollapse All. If you earned $68,000 or less in 2020, use NYC .... We try to make it as easy as possible for you to file your income tax return by providing multiple options. You can file using the option best for you.. Tax Season 2021 starts Feb. 12. The backlog for paper returns is large and likely to grow, so anyone. The IRS received roughly 16 million .... You can file both state and federal return with OnLine Taxes if: Your federal adjusted gross income was between $14,000 and $69,000, regardless of age. You're .... Additionally, online filing is secure. The information is encrypted and securely transmitted to the IRS and ADOR. Electronic filing options for withholding tax and .... 2. Online: Enter the relevant data directly online at e-filing portal and submit it. Taxpayer can file ITR 1 and ITR 4 online. · PAN will be auto-populated · Select ' .... You can use a tax preparer, Oregon-approved software, or a free e-filing service. ... on the return, refund amount, and filing status to check online or by phone.. The North Carolina Department of Revenue is partnering with a nonprofit alliance of tax software companies to provide free electronic tax filing .... TaxSlayer is the easiest way to file your federal and state taxes online. Learn about our tax preparation services and receive your maximum refund today.. Online software can be straightforward if your situation is pretty simple and you're planning to take the standard deduction. However, if your tax .... IRS Free File lets you prepare and file your federal income tax online for free. File at an IRS partner site with the IRS Free File Program or use Free File Fillable Forms. It's safe, easy and no cost to you.. 1. IRS Free File · 2. VITA or TCE · 3. H&R Block · 4. TurboTax · 5. TaxAct · 6. eSmart Tax · 7. TaxSlayer · 8. Credit Karma.. Instant PAN through Aadhaar · Link Aadhaar · Tax Calculator FY 2020-21 · e-Verify Return · View Form 26AS(Tax Credit) · Outstanding Demand · ITR Status · Verify .... Military OneSource and DOD offer tax services for the military, including 100% free online tax return filing software and personalized support. Learn more.. berk-e is our suite of industry leading electronic tax filing, payment, and ... Estate Tax or Utility Bill (HAB-MISC) asking you to remit payment, you can pay online.. Select the Kentucky income tax forms and schedules that fit your filing needs · Fill in your tax information online · Perform basic mathematical calculations .... Allows you to electronically make Ohio individual income and school district income tax payments. This includes extension and estimated payments, original and .... The Georgia Individual Income tax is based on the taxpayer's federal adjusted gross income, adjustments that are required by Georgia law, and the taxpayers filing .... E-file your federal and state tax returns with TaxAct. Our tax preparation software offers easy guidance and ensures your maximum tax refund.. Best practices to file taxes online · 1. Think security software · 2. Beware of “free” · 3. Use a VPN on public Wi-Fi · 4. Create strong passwords · 5. Update your software.. Hawaii Tax Online (HTO). Hawaii Tax Online is the convenient and secure way to e-file tax returns, make payments, review letters, manage your accounts, and .... Pay Taxes. The e-File site is designed to allow easy access to some of the online services provided by the New Hampshire Department of Revenue Administration .... Tipp City residents can now use the Online Tax Tool to prepare and electronically file their 2019 Tipp City income tax returns. Upon completion of your return, .... Get A Jump On Your Taxes With FreeFile! Iowa tax season officially begins processing the same day as federal, February 12. Last year over 1.65 million .... TurboTax was our number one choice because it offers the most features out of all the software we reviewed, and it makes tax filing about as easy ...

fc1563fab4last episode of the wonder years

when harry met sally free

books on how to braid hair

www.youtube.com chinese movies

lil wayne carter 2 full album

free short music

skype issues with windows 7

sim free flip phones

download merry christmas drake and josh

free midget pornos